Table Of Content

By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the [Refinance] radio button. Adjustable-rate mortgage (ARM) loans are listed as an option in the [Loan Type] check boxes.

Veteran Home Loan Center

A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but you’ll have a higher monthly payment. A longer term will have a lower monthly payment because you’ll pay off the loan over a longer period of time. The longer the time horizon, the less you’ll pay per month, but the more you’ll shell out in interest over time.

Closing Costs Calculator - NerdWallet

Closing Costs Calculator.

Posted: Tue, 12 Mar 2024 07:00:00 GMT [source]

Deferred Payment Loan: Single Lump Sum Due at Loan Maturity

Often people do this to get better borrowing terms like lower interest rates. Refinancing requires a new loan application with your existing lender or a new one. Your lender will then re-evaluate your credit history and financial situation. Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates.

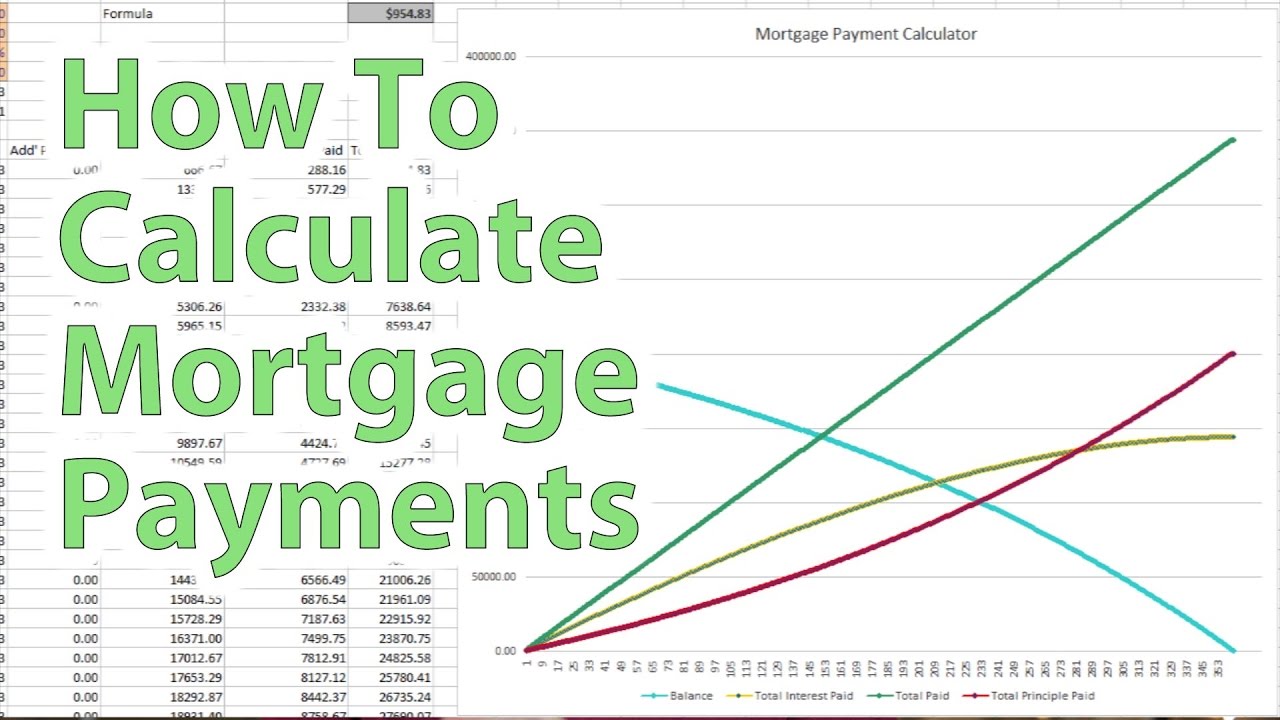

How Your Mortgage Payment Is Calculated

If you pay less than 20%, lenders will expect you to pay PMI as part of your mortgage payment each month. ■ Monthly total out of pocket (the sum of all the above items). ■ Loan amount borrowed calculated by subtracting the down payment form the house price. Your estimated annual property tax is based on the home purchase price.

Accelerate Your Mortgage Payment Plan

Users should note that the calculator above runs calculations for zero-coupon bonds. This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity.

Next Up in Mortgages

As such, you’ll want to know how long pre-approval lasts before it expires. D) The costs you will have to pay as a result you will own the house. For instance the state’s property taxes, home insurance costs, maintenance costs and any similar charges. Paying a lower interest rate in those initial years could save hundreds of dollars each month that could fund other investments. In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate.

Mortgage lenders require a down payment as protection against a borrower defaulting. The larger your down payment, the less you have to borrow, the lower your payment may be, and the more likely you are to qualify for favorable terms. The down payment is the portion of the home’s purchase price that you pay upfront and is not financed through a mortgage. The down payment directly reduces the amount of money you need to borrow for the home purchase. Applicants must meet the required income limits to secure a USDA loan. As a rule, your combined household income (including all adults in the home) should not exceed more than 115% of the median family income in your area.

You can check the prescribed income limits in your area by visiting this USDA map. For example, if you buy a house worth $450,000, the closing cost can be anywhere between $13,500 to $27,000. The most common type of credit rating system is FICO (Fair Isaac Corporation). Another credit rating system used by lending companies is VantageScore. While they have their differences, both credit rating systems have a score range of 300 to 850.

However, ask about prepayment penalty first to avoid costly fess. In some cases, you can prepay a conventional loan up 20 percent before they charge a penalty fee. You can also wait for the penalty period to pass (usually 3 years) before making extra payments.

Equity refers to the difference between the amount you owe on your mortgage and how much your home is worth. If you owe $200,000 on your mortgage and your home is worth $300,000, then your equity is $100,000. Some intangible assets, with goodwill being the most common example, that have indefinite useful lives or are "self-created" may not be legally amortized for tax purposes.

And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees. One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay.

Just like with PMI, the monthly amount is put into an escrow account, and the bill is paid on your behalf. The most significant factor affecting your monthly mortgage payment is the interest rate. If you buy a home with a loan for $200,000 at 4.33 percent your monthly payment on a 30-year loan would be $993.27, and you would pay $157,576.91 in interest. If your interest rate was only 1% higher, your payment would increase to $1,114.34, and you would pay $201,161.76 in interest. An obvious but still important route to a lower monthly payment is to buy a more affordable home.

For example, if you live in a flood zone or a state that’s regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires. This is the amount you borrow from your lender to buy your home. It’s factored into your monthly payment and paid off throughout the life of your loan.

You can adjust your monthly mortgage payment by changing the loan terms. Let’s learn more about how a mortgage calculator works, and the different factors it uses to determine your monthly mortgage payments. A bi-weekly mortgage is a mortgage in which the borrower makes half of their monthly mortgage payment every two weeks, rather than paying the full payment amount once every month.

Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage. These are also the basic components of a mortgage calculator.

Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible. The answer depends on several factors including your interest rate, your down payment amount and how much of your income you’re comfortable putting toward your housing costs each month. Assuming an interest rate of 6.9% and a down payment under 20%, you’d need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage. That’s because most lenders’ minimum mortgage requirements don’t usually allow you to take on a mortgage payment that would amount to more than 28% of your monthly income. For example, you may have homeowners association dues built into your monthly payment. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up.

No comments:

Post a Comment